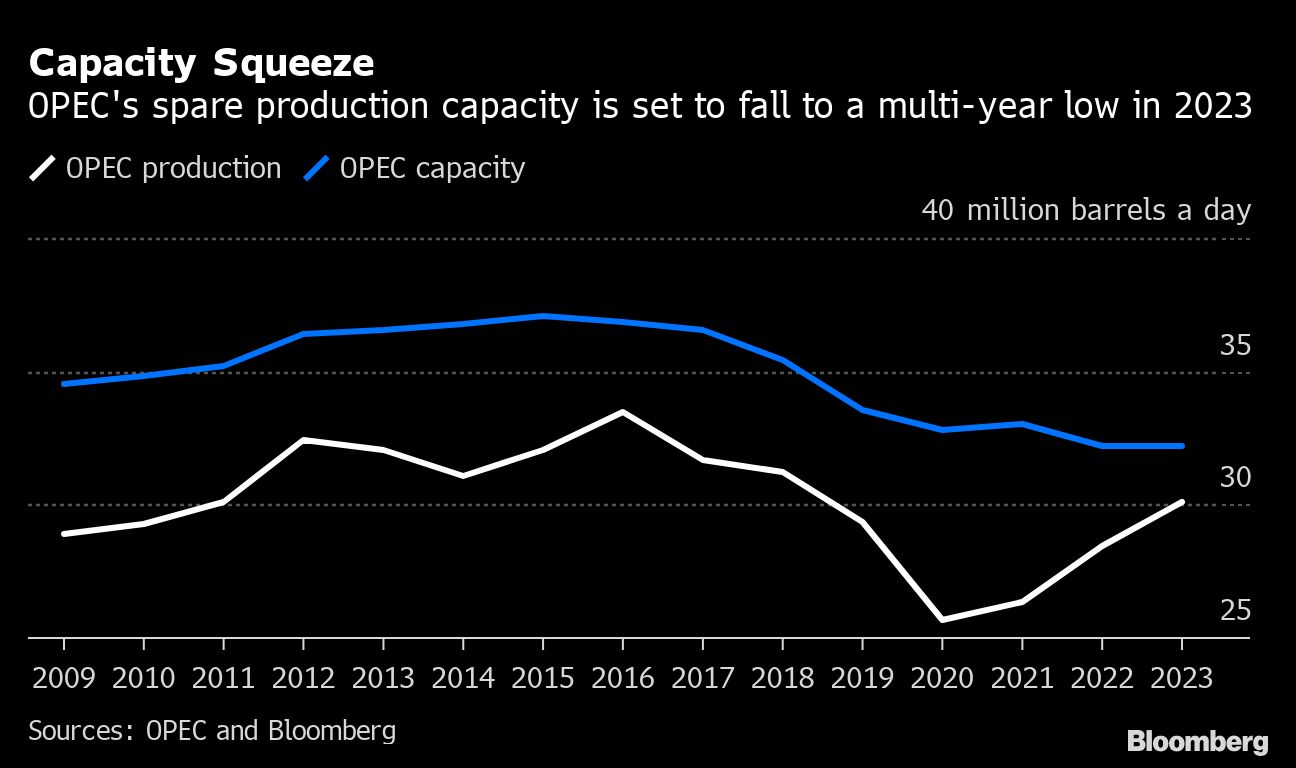

OPEC producers will need to pump crude at the fastest rate in five years in 2023 if they are to balance oil supply and demand. Capacity constraints suggest they might struggle.

The latest forecasts from the International Energy Agency, the US Energy Information Administration and the Organization of the Petroleum Exporting Countries all show that global oil demand will rise sharply again in 2023, despite the growing fears of rising inflation and weakening economic growth. A lack of investment in new crude production capacity means the OPEC producer group will have to pump more to meet that demand.

The three forecasters see global oil demand rising by at least 2 million barrels a day next year, bringing it back above 2019 levels for the first time since the COVID-19 pandemic hit early of 2020.

Producer Group forecasters are much more optimistic about oil demand than their IEA and EIA counterparts. Combining growth estimates for 2022 and 2023, they see a two-year increase of more than 6 million barrels per day. This compares to the 3.9 million barrels per day observed by the IEA and the 4.3 million barrels per day from the EIA.

The latest OPEC report assumes that neither the Covid pandemic, Russia’s invasion of Ukraine, nor global financial tightening amid soaring inflation are significantly undermining economic growth and that major economies “return to their growth potential”. He notes, however, that the uncertainties surrounding his forecast “remain on the downside”.

OPEC sees this growth bringing global oil demand to 103 million barrels per day on average in 2023. IEA and EIA see the figure at 101.3 million barrels and 101.6 million barrels per day respectively.

These demand figures are putting increasing pressure on OPEC countries to pump more, even though most of them are already producing as much as they can.

Combining the non-OPEC demand and supply outlook, the 13 OPEC members will need to deliver more than 30 million barrels per day on average in 2023, according to OPEC and the IEA. The EIA outlook puts the figure at 29.4 million barrels per day.

This is not a record production level for the group, but it would be the highest since 2018, according to OPEC’s own figures. More importantly, it would push the group’s spare capacity to a multi-year low of around 2 million barrels per day, based on Bloomberg’s assessment of sustainable production capacity in OPEC countries.

The last time current OPEC members collectively pumped more than 30 million barrels a day, the combined production of five of them – Algeria, Iran, Libya, Nigeria and Venezuela – was nearly 2.75 million barrels per day higher than in June. Only three members – Iraq, Saudi Arabia and the United Arab Emirates – pumped more last month than they did on average in 2018.

It is not the result of a voluntary restriction. The 10 OPEC members bound by the terms of the production deal they reached in 2020 with a group of non-OPEC allies pumped more than a million barrels a day less than their authorized goals last month.

OPEC members haven’t pumped as much as they’ve been allowed to since July 2020. Initially, that helped balance oversupply from its allies. More recently, it has reflected an inability to increase production in line with growing targets. Most of them already pump as much as they can.

The inability of OPEC producers to increase production rates with oil prices above $100 a barrel and growing demand for their crude does not bode well for the future. The group will have to pump about 1.36 million barrels more per day on average next year than last month.

This will put pressure on the production capacities of almost all of them. Unless, of course, demand growth is not as strong as forecasters suggest.